Preserving a Remote Contractors Lien in Tennessee the Notice of Nonpayment Requirement - Webinar

Part three on Tennessee lien laws. Notice of Nonpayment requirements, Notice of Lien requirements, and statutory forms for these documents.

Last updated:

Feb

13

,

2026

Published:

Aug 03, 2022

15 Mins

Read

Know about the Notice of Nonpayment, the rolling 90-day requirement, the consequences for not filing a Notice of Nonpayment, an example of the rolling 90-day requirement, whom to send the Notice of Nonpayment to besides the general contractor, the Notice of Lien, Notice of Lien requirements, permissible statutory form for the Notice of Lien, why a Sworn Statement is important, time of file various documents, and about the Lien Enforcement Demand and the Notice of Completion.

This blog is part two in a series on Tennessee lien laws where we will give the basics of what the lien law structure looks like in Tennessee, understand it a little bit, understand some of the pitfalls, and some of the things that you need to be aware of.

Part 1: Lien Law Basics – Who, What, and How Much?

Part 2: Preserving a Lien – Timing and Filing Requirements in TN

Part 3: Preserving a Remote Contractor’s Lien in TN – The Notice of Nonpayment Requirement

Part 4: Filing Suit to Perfect the Lien in TN

Part 5: Bonding a Lien in TN

Part 6: Overzealous and Improper Liens in TN

Part 7: Licensing Considerations – No License, No Lien in TN

Part 8: Can You Lien for Tenant Work in TN?

Part 9: What about Priority? - The Visible Commencement Standard in TN

Part 10: Other Rights – The TN Prompt Payment Act – Reasonable Assurances and Stopping Work

Part 11: Other Rights – The TN Prompt Payment Act – Notice and Remedies

Recap: Tennessee Lien Law Basics

a. Who has lien rights

In Tennessee there is a difference between remote contractor’s lien rights and prime contractor's lien rights.

b. For what work are lien rights valid?

It is all based on an improvement to the property which is relatively liberally construed.

c. On what property are lien rights valid?

Lien rights are valid on real property.

d. For how much are lien rights valid?

A lien secures the contract price.

Prime Contractors vs. Remote Contractors

In this blog we are going to talk about remote contractors’ lien rights and what a remote contractor has to do to preserve their lien rights. It is a little different than the prime contractor that we discussed in the last blog, and it is a little different from what we will discuss moving forward in terms of perfecting lien rights which is going to be back similar for prime contractors and remote contractors.

Step 1: Notice of Nonpayment – The Rolling 90-Day Requirement

In Tennessee, the Notice of Nonpayment is similar to what you will see in a number of other states but in a little bit of a different manner. For instance, in Georgia you have lien waivers that say you are not paid unless you file an affidavit within ‘X’ number of days.

This is Tennessee’s version of that, and what it is, is a practical requirement through the project that if money is not flowing downstream to remote contractors to get notice out there on paper to both the prime contractor and the owner.

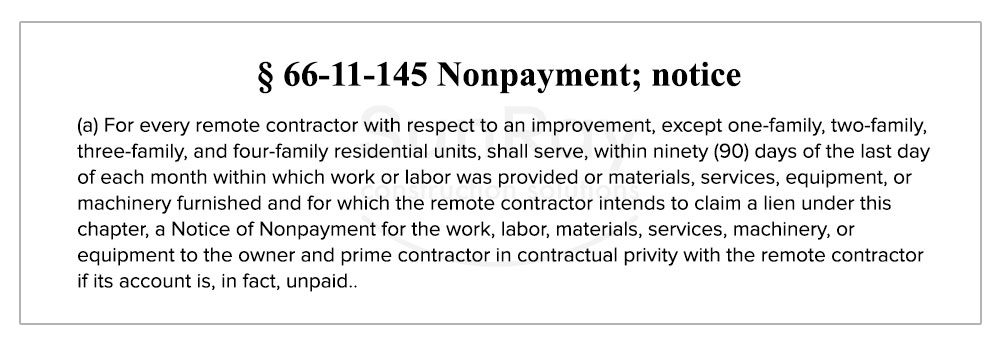

And where we see people trip up on this is they forget about this requirement, and it becomes fatal. so let us discuss it. The actual beginning of the statutory language is as follows:

a. Not required for residential projects

The Notice of Nonpayment is not required on residential projects and that is the first preamble you see above in the statute.

b. Rolling requirement within 90 days “of the last day of each month within which”

The second thing is that it is a rolling requirement required for work performed each month and its timing is with respect to when the work was performed. So basically, a Notice of Nonpayment can cover multiple months, but because it has to be served within 90 days of the end of the month when the work is performed, it can only cover at maximum, three months.

c. Mention work or labor provided, or materials, services or machinery furnished

So, when you have a situation where you are continuing to perform on a project, you need to make sure you are continually updating your Notice of Nonpayment. Each and every invoice and really the work included in those invoices is covered if you get to the point that you need to lien the property.

Now you will see that we are discussing about when the work or material is provided, then if things get messy and you are in a lien situation, one of the things that is going to be checked by the owner is “when was the work you invoiced actually performed?”

d. Send to owner and prime contractor

The Notice of Nonpayment has to go to the owner and the prime contractor. The owner is a very broadly defined entity within the Tennessee lien statutes, and it would include a lender who has a trust or anyone else who has claimed a lien or reported a lien. That can be a judgment lien or a tax lien, or another entity that is claiming a materialman’s lien on the property.

For instance, let us say you are invoicing in May for work or materials that were actually provided back in February or March. So, it is tricky to keep up with the accounting side of this. Because which we encourage Notices of Nonpayment to be sent relatively liberally. From a practical standpoint, make sure that you are preserving lien rights and make sure that everyone along the chain knows that a Notice of Nonpayment is coming if payment is not received.

It is not something that a remote contractor has a lot of flexibility with, and a conservative remote contractor will not go ahead and send one of these Notices of Nonpayment. They will take around 45 to 60 days if they have not been paid.

Notice of Nonpayment Requirements

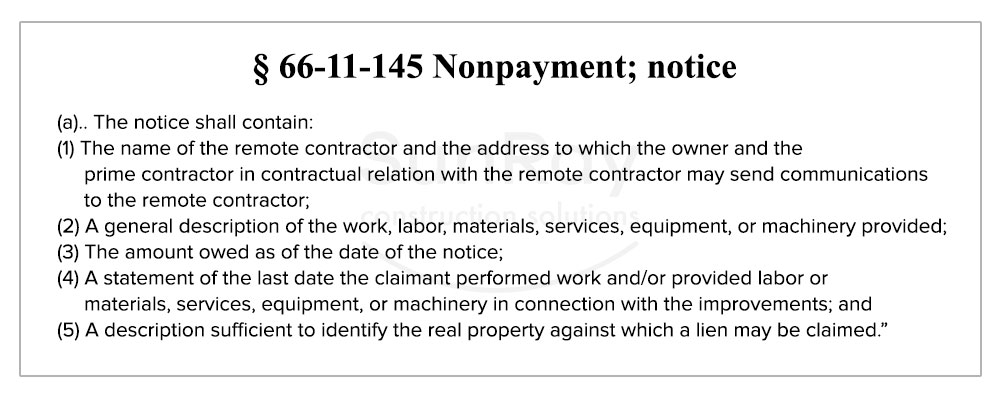

So what actually is a Notice of Nonpayment? It is a form, and the statutory language is given below:

a. Permissible statutory form

One of the things the Notice of Nonpayment form has is the last date the claimant performed work or provided labor or materials. It is a little vague as to exactly what is required for a prime contractor, but for a remote contractor (suppliers as well), the date they last performed work is something that has to be in the Notice of Nonpayment.

b. Remember presumptions from budling permit

The other thing is when you are looking at what is required as far as the owner’s name and prime’s name, those can all be copied and pasted from the building permit. One of the nice things within the Tennessee lien statutes is that there is a presumption on the owner's name, the prime contractor’s name, and the description of the property, that whatever is in the building permit is sufficient for lien purposes.

The other thing to remember is that you can also check if you are a remote contractor, the prime needs to be licensed and you can also get information as far as mailing addresses and the like from verify.tn.gov. So that is a secondary source you can use to get your hands on the building permit.

c. Sending/Delivery for broad options that include confirmation § 66-11-145

The other thing to note is how to send the Notice of Nonpayment. We will cover this in a bit more detail later in the blog. But it is really any form that is recognized that provides confirmation whether you are talking about priority mail like UPS, FedEx, and DHL. Any of those are going to have confirmation provided to you and will work.

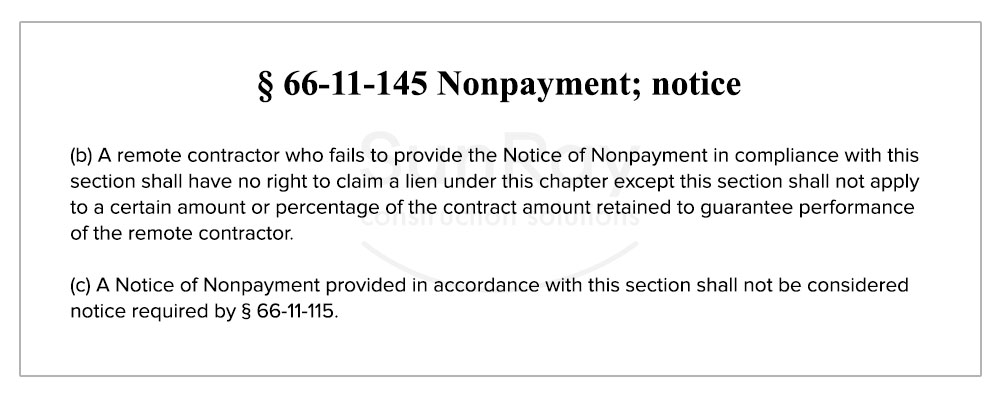

Notice of Nonpayment Consequences

What we want to enforce and reinforce is the failure to provide these Notices of Nonpayment along the way have very severe consequences, and that a remote contractor simply loses their lien rights. That is a big deal particularly when a remote contractor is in a situation and is not being paid because the owner is paying the prime contractor and the prime contractor is not releasing or the prime contractor is in big trouble.

In Tennessee, there is a case from 2015 called the Diaz case that basically says Notices of Nonpayment are substantive, and if the remote contractor does not provide statutory required notice to both the prime contractor and the owner, they simply do not have lien rights and will not make it past a motion to the dismiss stage in the lawsuit.

This is very important for a number of reasons including the fact that if you are a remote contractor lienor bringing a lawsuit, that you can actually be liable for all costs and attorney's fees, not just associated with the lien and the placement of the lien, but also the lawsuit as well.

Protect Your Rights with a Notice to Owner

Sending a notice to owner is the first step to secure payment on construction projects. Learn how a notice to owner Florida helps protect your lien rights and ensures you get paid.

Protect Your Payment Rights with Florida’s Most Trusted Notice & Lien Services

Notice to Owner – Secure your lien rights early. File your NTO now!

Notice to Owner Florida – Stay compliant with Florida deadlines. Send your NTO today!

Mechanics Lien Florida – Get paid faster. Start your Florida lien process now!

Notice to Owner Florida – Don’t Risk Your Lien Rights

Stay compliant with Notice to Owner Florida requirements. Send your Notice to Owner today and protect your payment.

Example of the Rolling 90-Day Requirement

Now, we will discuss an example because you hear this and sometimes it is hard to put it in perspective. So below is a hypothetical situation and it deals with a situation in which a remote contractor has provided some materials mid-January, working materials by the end of January, which they invoiced in February, and then they perform more work in February and invoice it again in March.

This is a pretty typical time fact pattern you would see from a remote contractor particularly sitting in May and let us say in late May. If you are a remote contractor and you decide you are going to send a Notice of Nonpayment on June 1. Your accounting department has a calendar, so you are good to go.

Analysis and Conclusion

Now the question you may have is, is sending a Notice of Nonpayment on June 1 preserve all of that remote contractor’s lien rights? You may be wondering now about the material you provided in January, let us say on January 10. Well, under the Notice of Nonpayment, you can go to the last day of the month of January, and then add 90 days to bring you to the beginning of May.

So, sending a Notice of Nonpayment on June 1 is not going to help. In fact, you would have already lost, or the remote contractor would have already lost their lien rights because they hadn’t sent a Notice of Nonpayment within 90 days after January 31.

Now whether you get $50,000 delivered on January 10 or $25,000 delivered on January 31, it is going to be the exact same analysis. If the remote contractor did not send a Notice of Nonpayment by early May, that $25,000 as far as lien rights go, is already gone.

What about if there is $125,000 that was delivered on February 10? Again, this one is going to be really dicey if you are sending the Notice of Nonpayment as of June 1. If the material was delivered on February 10, you get the benefit of the entire month until February 28 or February 29 in a leap year. Then you are going to add 90 days from there.

What you need to think about here is that there may be some exceptions for a June 1 Notice of Nonpayment where you could say on some accounting rules that the Notice of Nonpayment for the $125,000 would be good. But what we would suggest to you if you were in this situation that on May 20 you should go ahead and send the Notice of Nonpayment so that you certainly have rights in the $125,000 delivered in February.

The conclusion to this hypothetic scenario is that your accounting department has to have a quick turnaround as a remote contractor. This is to understand what has not been paid and make sure that the Notices of Nonpayment are going out. They need to go out not only to the general contractor, but to the owner as well.

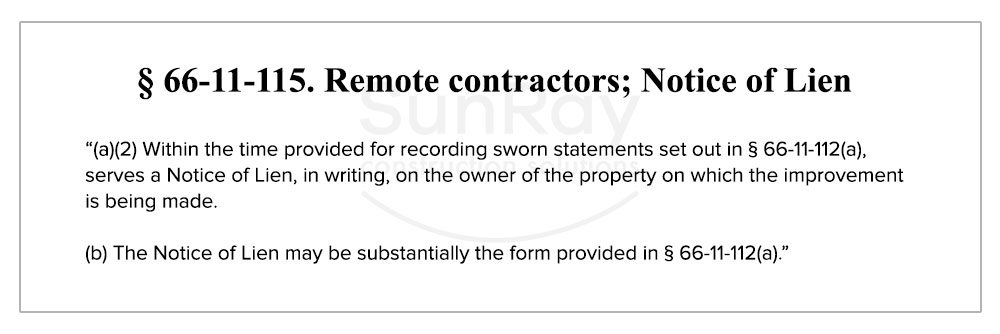

Step 2: Notice of Lien

The Notice of Lien is different from a Notice of Nonpayment and statutorily, the Notice of Nonpayment cannot serve as the Notice of Lien. The Notice of Lien is different from a Notice of Nonpayment, and statutorily, the Notice of Nonpayment cannot serve as the Notice of Lien.

They are two different forms, but both have to go to preserve lien rights for a remote contractor. Now, the requirement for a remote contractor is to serve a Notice of Lien on the owner. And again, the owner is anyone with a legal or equitable interest in the property.

Now what that does not say, is that you have to record a Notice of Lien with the Register of Deeds. What we will suggest to you is that if a remote contractor gets to a Notice of Lien standpoint, they should both send and serve the owner and record the Notice of Lien.

Notice of Lien Requirements

Now the references within the statutes all point you back to 11-112(a).

a. Record within 90 days

This section says that the Notice of Lien needs to be recorded within 90 days of the day the improvement is completed or abandoned. There is some argument within Tennessee practice as to whether that includes the work of the remote contractor or the work on the project. The answer is most likely to be from nay court looking at it, as the date the improvement as a whole is completed.

That said, there is an argument for an interpretation by the court to say that it is the improvement that is being liened by the remote contractor and thus it should be 90 days after the remote contractor completes or abandons the project.

From a conservative view, that is what we recommend. That said, if a lien has not been filed by a remote contractor within 90 days completion of their work, we would still suggest that the remote contractor continue to lien the property, so long as it is within 90 days of the date of the entire improvement.

b. Recording required for priority

Again, the reference over to Section 112 for remote contractors, is a good reminder that even if the court says you did not have to record your Notice to Lien as a prime contractor based on the statutory language, the remote contractor is going to lose their priority in the lien to anyone who comes along and buys the property. This is a very important aspect of the lien itself.

Now remember that you are going to serve that Notice of Nonpayment on the owner and the general contractor. The Notice of Lien is going to be served and recorded with the Register of Deeds.

Calculating the 90-Day Deadline

Now this is how you calculate the 90-Day deadline. Below is a section from the statute:

a. Reference is to the improvement

References are to the improvement and not the work of the remote contractor.

b. Do not rely on warranty or punch work

The references to the completion to record a Notice of Lien, has some differences in the case law. But the case law generally says that punch work and warranty are not going to extend out the time for which you have to serve your Notice of Lien against the property and to the owner.

c. Be aware of ‘deemed abandonment

The other thing that you have to be aware of as a remote contractor is if the project goes to a standstill. For some reason if the remote contractor does not know, be aware that there is potential for lien rights to be cut off if that lapses more than 90 days based on the content of the discussion that is going on between the owner and the prime contractor.

So, as a remote contractor, if there is a pause in the work on the entire project for 90 days, the remote contractor needs to be thinking about going ahead and proceeding with Step 2 of the process which is actually serving and recording the Notice of Lien.

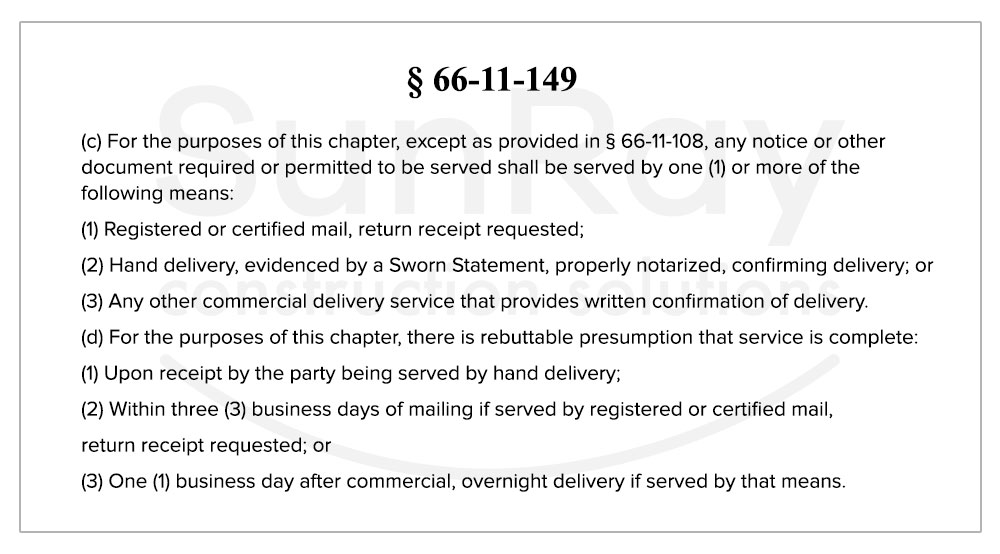

How to Notify

Luckily, there is some guidance within the Tennessee statutes that tell us exactly what is going to be acceptable. This section is as below:

As you can see in the section above, it is pretty broad. What we see that happens most often is not someone forgetting to serve by one of these methods, but it is a failure to keep records. So, if you are going to send out a Notice of Nonpayment, as well as the Notice of Lien requirement.

If you send them out, remember to send them in a way that there is confirmation of delivery, and that the confirmation delivery is kept in some way. Now, a lot of people use green cards and things like that. So long as you have the original green card, you can get back the confirmation and delivery from the delivery services website.

But you have to have that documentation as a remote contractor lienor.

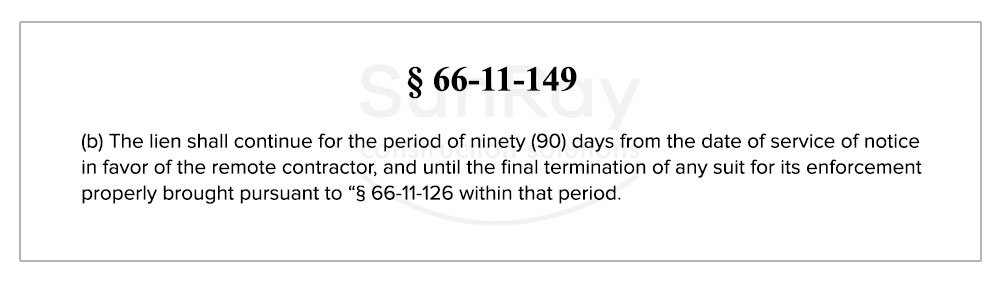

Step 3: Time to File

The next step is the attachment of the property and the commencement of the lawsuit. This section of the statute is as follows:

That is a rolling requirement for remote contractors from 90 days of the date of the service of the notice of lien is provided.

So, the earlier that the property is liened by a remote contractor, the earlier that the lawsuit and the attachment has to be filed. So, those two are interlinked for remote contractors and again, different from the prime contractors discussed in the previous webinar.

There is a lot to talk about in the sense of lawsuits and the attachment in those requirements, and what is required.

Summary

Now we will go through a brief summary of everything that was discussed in this blog.

a. Notice of Nonpayment

The Notice of Nonpayment has to be sent 90 days after the end of each month in which the work is performed, or the material delivered. That is the first thing you need to do as a remote contractor with regard to lien rights.

b. Notice of Lien

Then you have to serve or record the Notice of Lien within 90 days after the improvement is completed or abandoned.

c. Lien Enforcement Demand

Then within 90 days after that, you have to file the lawsuit.

d. Beware of Bond Deadlines

One thing you have to aware as you are looking at all this and the timing for a remote contractor, is whether or not there was a payment bond posted on the entire project to defeat any lien rights and if so, make sure that you know what is in that payment bond that has been reported. You do not want to miss some deadlines and they are presuming that the general lien deadlines are governing.

e. Notice of Completion

The sequence above for the three documents is not going to change. But the notice to serve and record your lien, and the lawsuit and attachment perfected can be shortened either by the owner or the prime contractor. This depends on what we are talking about.

Sunray Construction Solutions offers professional "Notice to Owner Florida" services to help you secure your mechanics lien florida rights in the construction industry. Looking for a free Notice to Owner form in Florida? Get your free, editable "Florida Notice to Owner Template" today for easy and accurate preparation.

.jpg)